Halal Mortgage In Canada: The Method It Works, Lenders To Consider

페이지 정보

본문

Otherwise, it would be much like the one who says, "O You who imagine, don't have interaction in prayer", neglecting the next words, "except when you're intoxicated", thereby negating the meaning of the verse. Contract complies with both sharia regulation as properly as Australian banking regulations. No two people or families are the same, and neither are their financial wants. Our Sharia-compliant Halal housing loans are meticulously tailor-made to match your specific circumstances, aspirations, and targets. You can trust that our experienced consultants will design a financing plan that matches seamlessly together with your way of life and monetary capabilities. Outside of Australia, Islamic banking isn't limited to cooperatives and small businesses.

Qard-based Halal Loans: A Tool For Socioeconomic Growth

Qard, an Islamic finance idea that promotes interest-free loans, has been transforming the landscape of halal loans. Many real-world examples showcase how Qard has revolutionized the way in which individuals and companies entry financing that aligns with... Fixed profit rates in Halal loans offer stability and certainty to borrowers and lenders alike. In Islamic finance, fastened profit charges are predetermined and do not fluctuate with market conditions.

How Does Sharia Financing Facilitate Home Ownership?

There are one other three products as nicely, and other lenders such as Iskan Home Finance produce other provides as nicely, although all purpose to be Sharia compliant. At Salaam Finance, we consider transparency is necessary after we join with our prospects. We supply funds from traders (who are paid a daily income based mostly on rental payments made by the owner) or it may come from wholesale markets. For conventional non-Islamic mortgages, they simplify to a loan superior by a lending institution to its buyer. They usually involve a product that may use an rate of interest (such as BBSW plus an additional revenue margin) when figuring out the extent of instalments charged to the customers.

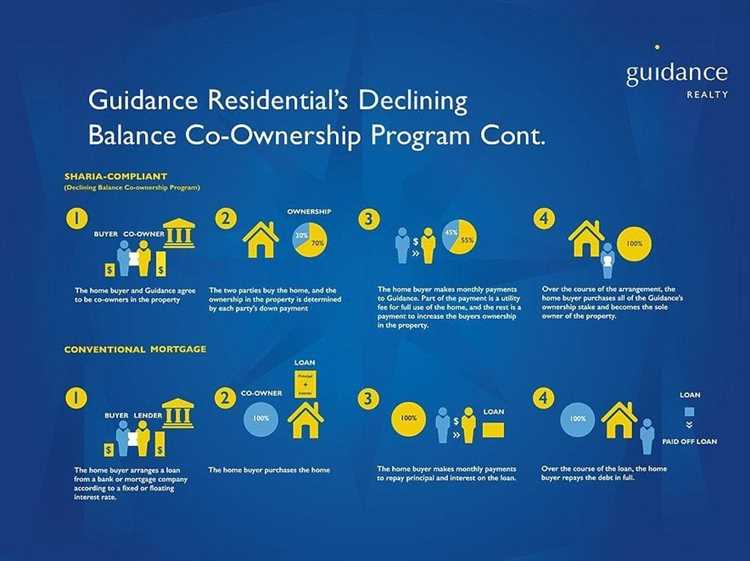

- Islamic home finance provides authentic buildings the place the monetary establishment and the house buyer co-invest funds.

- They are globally recognised students who are a part of industry leading our bodies corresponding to AAOIFI and the IFSB.

- There isn't any representation or warranty by Hejaz Financial Advisers that any of the data is accurate or complete.

- Melbourne-based investment advisory agency Hejaz Financial Services has additionally utilized for a banking licence after seeing huge demand for its sharia-compliant finance, mortgages and superannuation since 2013.

- At Halal Loans, our commitment to excellence goes beyond words – it’s reflected within the rave evaluations from our glad prospects.

Ensuring Transparency And Equity In Qard-based Halal Loans

With its adherence to ethical rules and prohibition of interest-based transactions, it supplies a viable various to standard banki... By implementing efficient threat management practices, monetary institutions can mitigate potential dangers and safeguard the pursuits of both lenders and borrowers. Shariah-compliant financing has emerged as a powerful device in empowering enterprise expansion for small and medium-sized enterprises (SMEs). By adhering to the ideas of Islamic law, this form of financing not solely offers SMEs with access to capi... Halal financing has emerged as a powerful tool in unlocking economic potential and driving infrastructure improvement. With its adherence to Islamic rules and moral standards, halal financing presents a unique avenue for investors and borrowers ...

Storage facilities must also be segregated to prevent any mixing of halal and non-halal products, and correct stock administration methods must be in place to maintain the traceability of halal goods. To tackle this demand, many beauty and personal care corporations are acquiring halal certification for his or her merchandise. This involves guaranteeing the entire provide chain, from sourcing raw materials to manufacturing and distribution, adheres to halal standards. Manufacturers may have to switch their formulations and processes to fulfill these requirements.

By adhering to Islamic finance ideas, these loans get rid of the need for borrowers to have interaction in interest-based transactions, that are considered haram (forbidden) in Islam. With the rise of halal financing choices in Australia, more and more Muslims are able to fulfill their homeownership desires while remaining true to their religious values. Halal mortgages function inside the framework of Islamic monetary principles, ensuring compliance with Sharia regulation and offering ethical financing solutions to Australian residents and traders. In Australia, Halal loans, as a halal mortgage broker, present Islamic finance services to meet the needs of the Muslim community in search of sharia-compliant products. These halal loans providers provide a halal mortgage various to traditional interest-based loans for property financing.

Getting home finance can seem complex, even when you’ve bought property earlier than. A automotive dealer should buy a automobile for $1,000 and sell it for $1,200 making a profit of $200, which may be expressed as 20%. On the opposite hand, a person can lend somebody a $1,000 dollars and demand that the borrower pays it again as $1,200, thus making a 20% interest. There is a misconception amongst the general public that Islamic finance is the same as standard, just because both specify the finance cost as a proportion.

Bankwest has confirmed that all workers at its remaining branches might be offered alternate employment options and that 15 Bankwest branches will convert to Commonwealth Bank branches. Shares in all four big banks hit one-year highs on Monday, with the CBA reaching a historic peak. Banking large Commonwealth Bank's share price hit an all-time intraday high of $119.37 on Thursday. If you loved this article and you would like to get much more information about monthly fees kindly pay a visit to our web page. Up to 30,000 Aussie Home Loan mortgage holders say they will struggle for refunds on alleged "worthless insurance coverage policies", after Shine Lawyers filed a class action within the Federal Court on their behalf. Follow the day's monetary news and insights from our specialist business reporters on our live weblog. Salaam Foundation companions and supports organisations and community groups to handle and solve real-world issues.

One distinctive facet of Ijara contracts within the area of home financing lies in their distinctive method to property possession. Ijara contracts are a elementary component of Islamic finance, providing a sharia-compliant alternative for Muslim home consumers seeking home purchase plans. In an Ijara contract, the Islamic banking establishment purchases the property and retains ownership whereas leasing it to the customer for an agreed-upon period. During this lease term, the customer pays rent to the establishment, which may embrace an ownership share component.

- 이전글камень рака мужчины - как выглядит лунный камень 24.07.27

- 다음글Main Judi Slot Online Indonesia Lewat Smartphone 24.07.27